A Brief Overview of 401Ks, Roth IRAs, and Individual Investing Accounts

When planning for retirement or financial growth, understanding your options—such as 401Ks, Roth IRAs, and individual investing accounts—is essential. Each has unique features, benefits, and considerations. Below, we’ll explore these tools, highlight where Roth IRAs outshine 401Ks, and explain why prioritizing your 401K company match is a smart move.

401Ks: Employer-Sponsored Retirement Plans

A 401K is a retirement account offered by many employers, allowing you to save pre-tax income for the future. Contributions reduce your taxable income now, but withdrawals in retirement are taxed as ordinary income. One of the strongest advantages of a 401K is the employer match, where your company contributes a percentage of what you put in, often up to a set limit (e.g., 3-6% of your salary). This is essentially additional compensation, making it a high-priority step in your financial strategy. However, 401Ks typically offer a limited selection of investment options, determined by the plan provider, which can restrict your flexibility.

Roth IRAs: Tax-Free Growth Potential

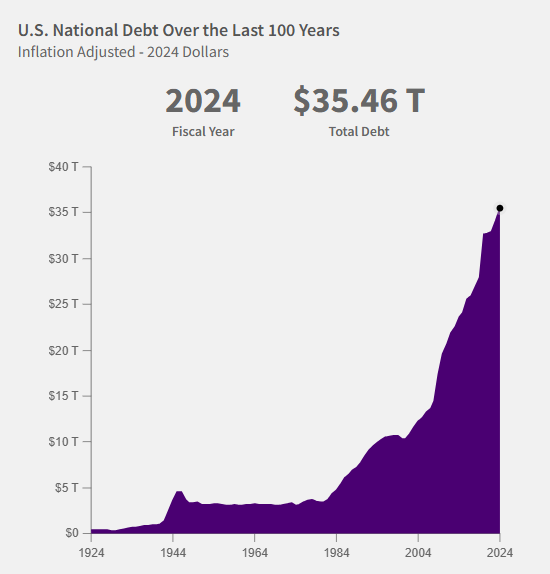

A Roth IRA is an individual retirement account funded with after-tax dollars—meaning you pay taxes on the money before contributing. The key benefit is that qualified withdrawals, including earnings, are tax-free in retirement. This makes Roth IRAs particularly appealing if you anticipate being in a higher tax bracket later in life or if tax rates increase over time. Unlike 401Ks, Roth IRAs offer greater investment flexibility, allowing you to choose from a wide range of assets, such as stocks, bonds, or ETFs. Additionally, you can withdraw your contributions (but not earnings) at any time without penalty, providing more liquidity than a 401K, which imposes penalties for early withdrawals.

Roth IRAs stand out over 401Ks in two main areas: tax-free withdrawals and investment control. If maximizing long-term tax savings or having freedom in your portfolio matters to you, a Roth IRA can be a powerful tool.

Individual Investing Accounts: Flexible but Taxable

Individual investing accounts are standard brokerage accounts with no special tax advantages or contribution limits. They offer complete control over your investments and no restrictions on withdrawals, making them useful for goals outside of retirement or as a supplement to other accounts. However, gains are subject to capital gains taxes, so they lack the tax efficiency of 401Ks or Roth IRAs.

Prioritization Strategy

To optimize your savings, start by contributing to your 401K up to the employer match limit—this ensures you capture the full benefit of that contribution. Next, if eligible (Roth IRAs have income limits), max out your Roth IRA to take advantage of tax-free growth and flexibility. After that, return to your 401K to contribute beyond the match, up to the annual limit, for additional tax-deferred savings. Finally, if you have more to invest, consider an individual account.

In summary, prioritize your 401K match first for its immediate benefit, then leverage a Roth IRA for its tax-free withdrawals and investment options. Together, these accounts, supplemented by individual investing, can build a solid foundation for your financial future.

As Always - We are here to help you reach your goals. If you found this post helpful, please share with a friend. If you have any ideas or comments, please feel free to share.