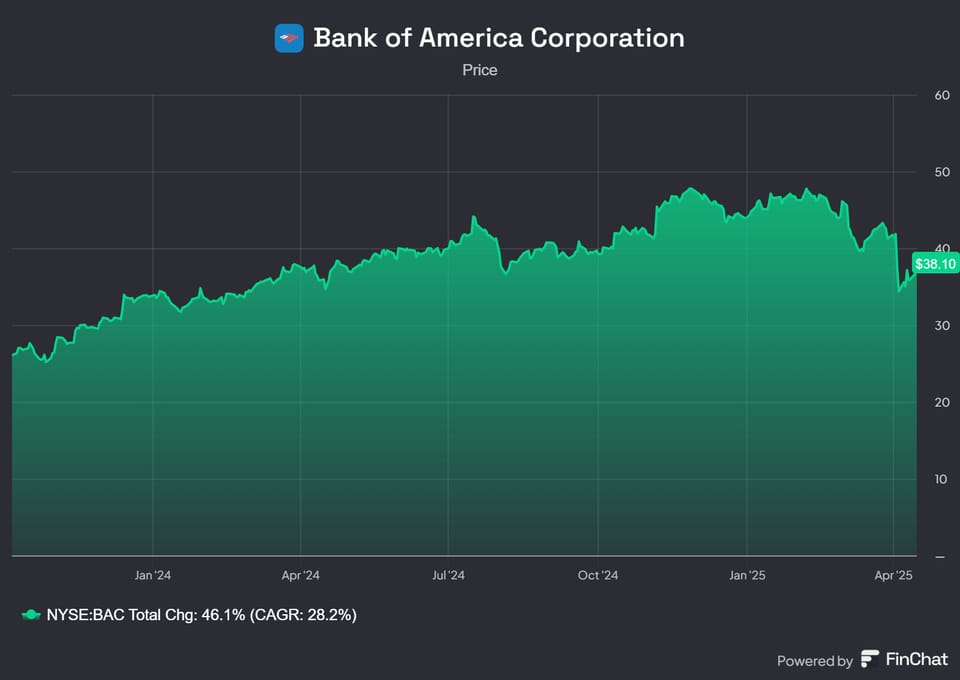

Bank of America Reports Strong Q1 2025 Performance Amid Economic Uncertainty

Bank of America Corporation kicked off 2025 with a robust first-quarter performance, as detailed in its recent earnings call. The bank reported a net income of $7.4 billion and earnings per share (EPS) of $0.90, marking a solid start to the year. CEO Brian Moynihan and CFO Alastair Borthwick highlighted key achievements and provided insights into the bank’s strategy to navigate potential economic shifts.

Financial Highlights

- Revenue Growth: Revenue reached $27.5 billion, up 6% year-over-year, driven by a 3% increase in net interest income (NII), a 15% rise in investment and brokerage fees, and a 9% growth in sales and trading revenue.

- Earnings Strength: Net income grew 11%, and EPS surged 18% compared to Q1 2024, reflecting strong operating leverage and disciplined expense management.

- Capital Returns: The bank returned $6.5 billion to shareholders, including $2 billion in dividends and $4.5 billion in share repurchases, reducing outstanding shares by 4% from the prior year.

- Balance Sheet Resilience: Deposits grew for the seventh consecutive quarter, nearing $2 trillion, while loans increased 4% year-over-year, with commercial loans up 7%. The bank maintained a strong CET1 ratio of 11.8% and nearly $1 trillion in liquidity.

Organic Growth and Digital Engagement

Bank of America emphasized its consistent organic growth across its business segments:

- Consumer Banking: Added 250,000 net new checking accounts, marking 25 consecutive quarters of growth. Consumer investment balances rose 9% to $498 billion.

- Wealth Management: Added 7,200 net new households and saw $24 billion in assets under management (AUM) flows, with revenue up 8% year-over-year.

- Global Banking and Markets: Commercial loans grew across all lines, and sales and trading revenue increased 9%, achieving a 16% return on allocated capital.

- Digital Momentum: Digital sales accounted for 65% of consumer product sales, with over 14 billion logins in 2024 and 2.7 billion interactions with the bank’s AI assistant, ERICA.

Navigating Economic Uncertainty

With market volatility and concerns about tariffs and policy changes, Moynihan and Borthwick addressed the bank’s preparedness:

- Credit Quality: Asset quality remains strong, with net charge-offs stable at $1.45 billion and a provision expense of $1.5 billion. Consumer credit card charge-offs, at 4%, have normalized to pre-pandemic levels, supported by high-quality underwriting (average FICO score of 777).

- Economic Outlook: The bank’s research team does not anticipate a recession in 2025 but has lowered GDP growth forecasts. Consumer spending grew at a 4.4% pace in Q1, consistent with Q4 2024 trends, indicating resilience.

- Risk Management: The loan portfolio is more diversified and secure than in past periods of stress, with over 90% of commercial loans investment-grade or collateralized. Reserves are positioned for an unemployment rate of approximately 6%, well above current levels.

Forward Guidance

- Net Interest Income: The bank expects Q4 2025 NII to range between $15.5 billion and $15.7 billion, supported by fixed-rate asset repricing and modest loan and deposit growth, despite potential rate cuts.

- Expenses: Full-year 2025 expenses are projected to rise 2-3% over 2024, in line with investments in technology and client-facing staff.

- Capital Strategy: Bank of America plans to “grow into” its capital base, balancing business investments with robust share buybacks, leveraging its CET1 cushion above the 10.7% requirement.

Strategic Positioning

Moynihan emphasized the bank’s ability to support clients through economic cycles, citing a diversified loan book, reduced exposure to unsecured consumer loans, and enhanced digital capabilities. The bank’s $1.2 trillion in cash and government securities provides flexibility to meet client needs, though Moynihan noted potential relief from regulatory constraints, such as the Supplementary Leverage Ratio (SLR), could optimize capital deployment.

Looking Ahead

Bank of America’s Q1 2025 results underscore its operational strength and strategic foresight. While economic uncertainties loom, the bank’s diversified portfolio, strong balance sheet, and ongoing investments position it to thrive. As Moynihan concluded, “Our job is to serve our clients in all times, and that’s what we plan to do.”