Can SoFi Reach $25 In 5 Years?

SoFi Technologies (SOFI) Next 5 Years

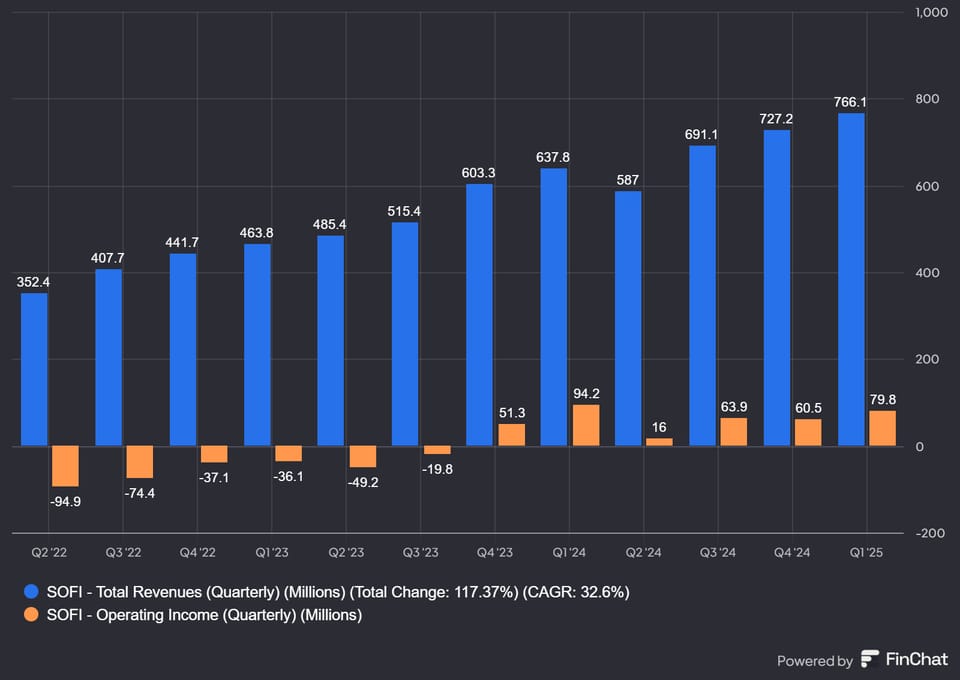

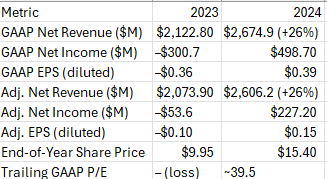

Fundamental Analysis: SoFi’s financial position has strengthened, with revenue and profitability rising in 2024–2025. In Q4 2024, GAAP revenue was $734.1M, up 19% YoY, driving FY2024 revenue to $2.675B (+26% YoY). SoFi reported GAAP net income $498.7M for FY2024 (EPS $0.39), reversing a prior-year GAAP loss of $300.7M. Much of this GAAP profit reflects one-time tax benefits; on an adjusted basis SoFi earned $227.2M (EPS $0.15) in 2024, versus an adjusted loss of $53.6M in 2023. Liquidity remains ample – SoFi ended Q1 2025 with ~$2.1B cash. – and debt levels are modest (the company has a small amount of convertible debt, but no material long-term operating debt disclosed). Importantly, SoFi now operates as a national bank (SoFi Bank, N.A.), subject to OCC/Federal Reserve supervision. This “bank charter” status means SoFi’s deposits are FDIC-insured (enhancing stability), but also subjects it to higher capital and compliance requirements. Overall, SoFi’s business is now profitable on a recurring basis (6 consecutive profitable quarters) and generating strong operating cash flow (Q4 2024 operating cash $59M).

Growth Prospects: SoFi is executing on a broad multi-product strategy. It reported record member growth (34% YoY to 10.1M in Q4 2024) and record product growth (34% YoY). Its offerings span lending (student, personal, mortgages, credit card), banking (deposit accounts via SoFi Money), and investing. In Q4 2024, fee-based revenue (mainly from banking and technology services) hit a record $289M (+63% YoY). reflecting growth in high-ROE, capital-light segments. SoFi’s “Financial Services Productivity Loop” – using lending profits to acquire deposit/investment customers – appears to be working: products per customer rose to 12.7M financial services products (deposits, accounts, etc.) by end-2024. Management expects ~2.8M new members in 2025 (28% growth). SoFi is also expanding its tech platform (Galileo) – recently winning major contracts (e.g. U.S. Treasury payment card program) – which diversifies revenue. The company has signaled interest in re-launching crypto trading and other features once “regulatory clarity” arrives (CEO Noto has said SoFi wants to offer crypto/blockchain products across its business lines). In sum, SoFi’s addressable market is large (many hundreds of millions of U.S. consumers for loans, banking, investing) and its rapid member/product growth suggests significant room to run if it can sustain execution.

Key Financial Metrics (2023–2024):

Profitability & Margins: SoFi’s GAAP net margin turned positive (~18.6% in 2024), but this was boosted by non-recurring tax benefits. On a normalized basis, adjusted net margins are slimmer (~8–9%). However, adjusted EBITDA margins are healthy – for Q1 2025 adjusted EBITDA was 27% of revenue. SoFi’s loan default rates have improved (Q4 2024 personal loan 90-day delinquency 0.55%), which bodes well for future credit costs. Overall, profitability is rising as SoFi crosses scale, and management is targeting sustained profitability: they raised 2025 EPS guidance to ~$0.27–0.28.

Management & Strategy: CEO Anthony Noto (former Twitter/Citi executive) has emphasized innovation and brand-building. He declared “2024 was SoFi’s best year ever” – new records in revenue, profit, members, and products – and is raising guidance. Strategy highlights include shifting mix toward high-ROE businesses (banking services, tech platform) and vertically integrating product offerings (lending fuels deposits and investing). SoFi’s management has proven it can scale rapidly while moving to profitability, but execution must continue: they plan to roll out new credit products, expand into auto and crypto markets (once permitted), and grow partnerships (e.g. BlackRock robo-advisor). The board and exec team are experienced, and insider ownership (Noto holds stock) aligns incentives.

Competitive Position & Risks: SoFi faces competition from traditional banks, fintechs, and online brokers. Key peers:

- Affirm (AFRM) – a BNPL specialist. Affirm’s revenue growth has been strong (~45–50% YoY) but it remains net-loss (narrowed in 2024). Its focus on point-of-sale credit competes with some SoFi lending products. Upcoming BNPL regulations (CFPB) could impact Affirm and similar players.

- Block (SQ) – Incumbent payments giant with Cash App and Square. Block is far larger (~$29B mkt cap) but is growing single-digit (FY24 revenue +10%). Block is profitable (FY24 adj. EPS $3.37) and expanding financial services (savings, loans) – a formidable, well-capitalized competitor.

- Robinhood (HOOD) – trading app-turned-fintech. Robinhood’s Q4/2024 net revenue soared 115% to $1.01B (full-year $2.95B) and it swung to net profit ($1.41B in 2024) mainly on crypto and one-time tax benefits. While Robinhood’s core is investing/trading (different users), it competes in deposits and messaging of fintech. Robinhood’s rapid growth (account funding, deposits, AUC all surging shows consumer appetite for digital finance.

- Others: PayPal, LendingClub, Upstart, Chime (private), and banks are all vying for the same customers. SoFi’s broad product suite and aggressive marketing give it an edge, but cross-selling all products remains a challenge.

Regulatory risk is notable. SoFi’s OCC-approved bank charter (SoFi Bank) brings oversight: the OCC explicitly noted SoFi will be “subject to comprehensive supervision…and the full panoply of bank regulations”. This caps aggressive risk-taking (e.g. no crypto business for the bank) and requires strong capital. On the upside, bank status lets SoFi fund loans with deposits at scale (improving margins). Interest rate policy is a double-edged sword: higher rates (Fed funds ~5%) boost SoFi’s interest income on loans/deposits, but may dampen loan demand (refinancings, mortgages) and raise default rates. A recession or credit crunch could hurt all fintech credit businesses. Inflation and economic growth forecasts (slowdown to ~2% GDP in 2025) suggest moderate consumer credit growth. Overall, macro is neutral-to-slightly-challenging.

Analyst Sentiment & Valuation: Consensus is cautious. SoFi’s Wall Street rating is roughly “Hold”. and the average 1-year target (~$11.60) implies limited upside from current ~$12–13. Analysts acknowledge strong growth but note high valuation. Currently SoFi trades around 20–25× adjusted 2024 EPS (or ~40× GAAP EPS) – a rich multiple for a still-maturing fintech. By comparison, Block trades ~14× forward earnings (FY25 guidance ~ $2.1B op income on $10.2B revenue)and Robinhood ~30× (based on 2024 EPS $1.56). Affirm is not profitable (negative P/E). To justify a future $25 price, SoFi must both grow earnings and sustain a high multiple.

Technical Analysis: SOFI has been volatile. It peaked near $25.78 in Feb 2021, then plunged to ~$6 by late 2022 amid the crypto/tech selloff. It bottomed ~6.0 in Oct 2022 and has since rallied into 2024, trading ~12–15 in 2024. Recent trend: price has reclaimed its 50-day and 200-day moving averages, suggesting bullish momentum (current 50DMA ~$12.4, 200DMA ~$11.1. Short-term support is around $11–12 (seen in early 2025). Resistance appears near $14–15 (previous highs in summer 2024), then around $18 (2024 intra-year high), and the all-time high $25. Technical indicators are mixed: MACD is near neutral/bearish (slightly negative) but short-term EMAs are below price (a bullish sign). Trading volume has been moderate, with no clear head-and-shoulders or double-top pattern. In sum, the chart shows a base near $6–7 and a multi-month uptrend off that bottom, but a clear break above $18–20 would be needed to embolden bulls.

Peer Chart Patterns: (Briefly) Block (SQ) chart has similar dips in 2022 and recovery into 2024, but broke down again in late 2024 on earnings. Robinhood (HOOD) saw a massive spike late 2024 (due to crypto/news) then retraced. Affirm (AFRM) chart is still below its 2021 highs and looks rangebound. Overall, fintech charts have been volatile and driven by news/cycles.

Conclusion: Path to $25

To reach $25 in 5 years (roughly double today’s ~$12), SoFi needs both continued business growth and multiple expansion. Scenarios that could make $25 plausible:

- Sustained high growth: If SoFi maintains ~25–30% annual revenue growth (driven by new members/products and market share gains), 2029 revenues could be ~$7–8B. If it also achieves healthy profitability (say mid-teens EBIT margins), EPS could be $1.00–$1.20 by 2029 (vs ~$0.06 GAAP in Q1 2025). At today’s ~40× GAAP P/E, that still gets only ~$40 price – so even that is optimistic. More realistically, if it trades at ~25× EPS on ~$1.00, price ~25. So the math requires both far higher profit and a premium multiple.

- Profit transformation: Eliminating one-time distortions and continuing cost discipline, SoFi’s GAAP EPS could climb quickly (guidance is $0.27–0.28 for 2025 vs $0.39 for 2024). If this growth accelerates and the company attains sustained net margins, Wall Street might re-rate the stock. Meeting or beating guidance consistently is critical.

- Market Sentiment: Fintech hype could return (e.g. crypto bull run, digital banking boom, AI-driven finance products) that re-ignites investor appetite. Strategic wins (like global expansion or big acquisitions) could also boost valuation.

- Macro Tailwinds: A stronger economy with low default rates, stable high interest rates (boosting NII), and favorable regulations (BNPL rules favorable to SoFi’s model, crypto/trading allowed) would help.

Downside factors that would keep SoFi below $25: slower growth (e.g. revenue <15% CAGR as competition heats up), loss of profitability momentum, adverse rate/cycle changes, or general market derating of tech/fintech valuations. Also, if customers stick with incumbents or SoFi fails to cross-sell as planned, revenue growth may stall.

Outlook: SoFi has many strengths – scale in fintech, growing diversified business, improving profitability, and a clear growth strategy. However, reaching $25 requires roughly 2× the current market capitalization (from ~$14B to ~$28B) in an industry where peers are growing more slowly. It’s plausible if SoFi continues its torrid growth and executes flawlessly (members hitting ~20M+, capturing market share in multiple segments). But anything less than near-best-case execution makes $25 look ambitious. In neutral scenarios, $25 would require a valuation well above today’s norms. In summary, $25 by 2030 is possible but challenging: it will likely require continued revenue growth at 25–30%+ and a premium P/E (20–30×) driven by strong execution. Investors should watch growth metrics (members, cross-sell, revenue mix) and profitability improvements – if these all trend upward, the stock could approach $25. If growth falters or costs rise, the stock may remain closer to the $10–15 range.