Goldman Sachs Q1 2025

Date: April 14, 2025

Strong Financial Performance Amid Volatility

Goldman Sachs kicked off 2025 with robust first-quarter results, reporting net revenues of $15.1 billion, earnings per share of $14.12, an ROE of 16.9%, and an RoTE of 18%. CEO David Solomon highlighted the firm’s ability to deliver in a “highly dynamic environment,” crediting its global franchise, elite talent, and disciplined risk management for navigating rapidly shifting market sentiment.

Global Banking and Markets: Powering Through

The Global Banking and Markets segment shone with $10.7 billion in revenues and an ROE exceeding 20%. Key highlights include:

- FICC (Fixed Income, Currencies, and Commodities): Generated $4.4 billion, driven by strong client activity in currencies and mortgages, though credit and rates lagged last year’s highs.

- Equities: Achieved a record $4.2 billion, up 28% year-over-year, fueled by derivatives and record financing revenues of $1.6 billion.

- Investment Banking: Advisory revenues fell to $792 million amid volatility, but Goldman retained its #1 global M&A ranking, advising on landmark deals like Google’s $32 billion acquisition of Wizz and Walgreens’ $24 billion take-private. The deal backlog grew for the fourth straight quarter, though execution hinges on market stability.

Asset and Wealth Management: Record Growth

The Asset and Wealth Management division posted $3.7 billion in revenues, with assets under supervision hitting an all-time high of $3.2 trillion. Notable achievements:

- Marked 29 consecutive quarters of long-term fee-based inflows, with $29 billion in Q1.

- Raised $19 billion in alternatives, contributing to $342 billion since 2019.

- Wealth management revenues rose 11% to $2.2 billion, with client assets at $1.6 trillion, supported by over 1,000 private wealth advisors. Goldman earned the title of World’s Best Private Bank for 2025 from Euromoney.

Capital Management: Returning Value

CFO Dennis Coleman underscored disciplined capital allocation:

- CET1 ratio stood at 14.8%, 110 basis points above requirements.

- Returned $5.3 billion to shareholders, including a record $4.4 billion in stock buybacks and $976 million in dividends.

- Authorized a $40 billion multiyear share repurchase program, signaling confidence in long-term capital flexibility.

Efficiency and Expenses

Operating expenses totaled $9.1 billion, yielding a 60.6% efficiency ratio. As part of a three-year efficiency plan, the firm anticipates a $150 million severance charge in Q2 to adjust its pyramid structure, aiming to free up resources for technology investments, including AI-powered tools enhancing productivity.

Macro Outlook: Navigating Uncertainty

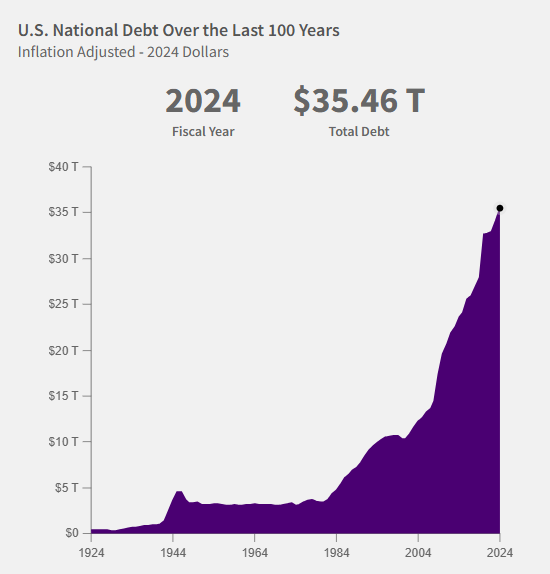

Solomon cautioned about a challenging macro environment, with U.S. growth forecasts slashed to 0.5% and rising recession risks tied to trade policy uncertainties. Globally, clients express caution, seeking clarity on policy directions. Despite this, Goldman’s scale and expertise position it to support clients through volatility, with Solomon optimistic about potential regulatory tailwinds, including possible reforms to SLR, capital rules, and supervision.

Closing Thoughts

Goldman Sachs delivered a solid Q1, leveraging its diversified franchise to thrive in turbulent markets. While uncertainties loom, the firm’s leadership remains confident in its ability to serve clients and return value to shareholders, staying agile in an evolving global landscape.