Planning for Your Future - Your Pension

Planning for Your Future: Key Highlights from the Nebraska School Employees Retirement System Handbook

As a Nebraska teacher, understanding your retirement plan is a crucial step toward securing your financial future. The Nebraska School Employees Retirement System Handbook (revised January 2025) outlines the details of the School Employees Retirement Plan, a Defined Benefit Plan administered by the Public Employees Retirement Board (PERB) for all public school employees in Nebraska (excluding Omaha Public Schools, University of Nebraska, State Colleges, and Community Colleges). Here’s a concise summary of what you need to know to plan effectively for retirement.

Your Retirement Benefit: How It Works

- Defined Benefit Formula: Your monthly pension is calculated using your years of creditable service, your final average monthly compensation (highest salary periods), and a 2% formula factor (if employed on or after May 2, 2001, with at least half a year of service). Unlike a 401(k), your contributions don’t directly determine your benefit—it's a lifetime pension based on this formula.

- Benefit Tiers: Your benefits depend on when you joined the plan:

- Tier 1: Before July 1, 2013

- Tier 2: July 1, 2013 – June 30, 2017

- Tier 3: July 1, 2017 – June 30, 2018

- Tier 4: On or after July 1, 2018 Most provisions are similar, but differences (like COLA rates) are noted in the handbook.

Membership and Contributions

- Mandatory Participation: If you’re a permanent employee working 20+ hours per week (or on a full-time contract), you’re required to join. Even if you start below 20 hours, averaging 20+ hours over three months triggers enrollment.

- Contributions: You contribute 9.78% of your gross compensation, matched by your employer at 101%. The State of Nebraska adds 2%, and investment earnings bolster the fund. Note: only your contributions accrue to your account; employer and state funds support the overall system.

Vesting and Eligibility

- Vesting: You’re eligible for a monthly benefit after 5 years of service credit or reaching age 65 with at least half a year of service (exceptions apply for post-July 1, 2016 members). Unvested members can only take a refund of contributions plus interest.

- Creditable Service: Earned through hours worked (1,000+ hours = 1 year since July 1, 2002), including paid leave. You can boost service credit by repaying refunds or purchasing optional service (e.g., military, out-of-state teaching, or pre-retirement years).

Retirement Options

- Age Milestones:

- Age 65: Unreduced normal retirement.

- Rule of 85: Unreduced early retirement if age + service = 85 (Tiers 1-3: age 55+; Tier 4: age 60+).

- Age 60: Reduced benefits (3% reduction per year under 65).

- Payment Options: Choose from Life Only, Modified Cash Refund, Period Certain (5, 10, or 15 years), or Joint and Survivor (50%, 75%, or 100% to a spouse). Your choice is permanent after your effective date, so plan carefully.

Key Actions to Take

- Apply for Benefits: Retirement doesn’t start automatically—contact NPERS 3 months before your planned date to avoid delays or lost payments. Missing Required Minimum Distribution (RMD) deadlines (age 70½-75, depending on birth year) can forfeit your pension.

- Track Your Account: Review your annual Account Statement for service and salary accuracy. Report errors promptly to NPERS.

- Plan for Reemployment: A 180-day break is required after termination to take a refund or benefit. Returning to work? You’ll rejoin as a new member unless you repay a prior refund.

Additional Perks and Protections

- Cost-of-Living Adjustment (COLA): After one year of retirement, Tier 1 gets up to 2.5% (or more if purchasing power drops below 75%), while Tiers 2-4 cap at 1%.

- Death Benefits: Designate beneficiaries wisely—spousal options offer a lifetime annuity if you die before retiring with 5+ years of service.

- Taxation: Benefits are taxable, but pre-1986 contributions are tax-free. Refunds face a 20% federal and 5% Nebraska withholding unless rolled over.

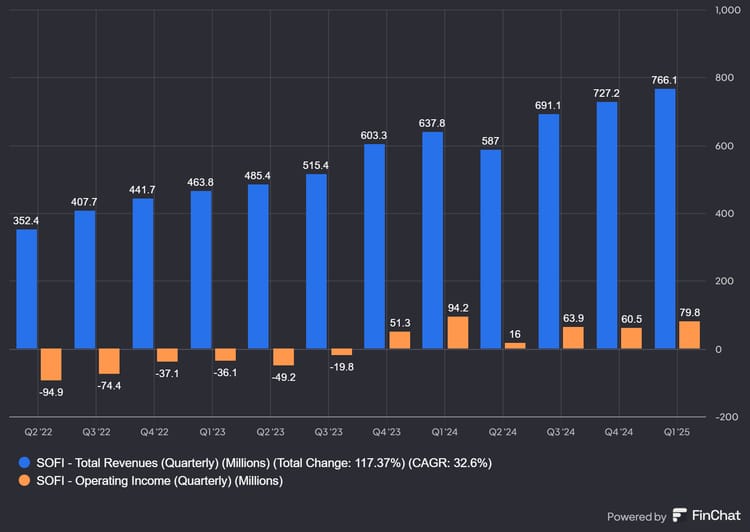

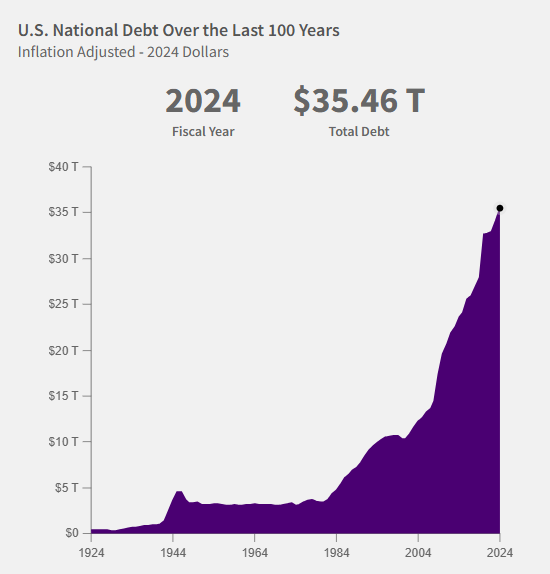

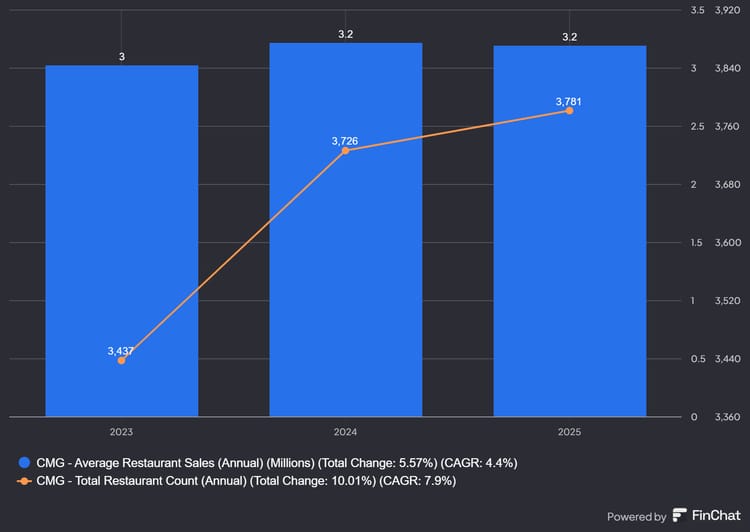

Boosting Your Retirement Beyond the Pension

This pension is a fantastic foundation for your retirement, but you can do more to grow your wealth. For deeper insights into investing options, join our subscriber list! Each month, we pick two stocks to highlight on the first of the month, giving you actionable ideas to diversify and strengthen your financial future alongside your NPERS pension.