📦 Prologis Q1 2025: The Good, the Bad, and the Unpacking Ahead

TLDR: - Not a Bad Quarter, but their are better investments today.

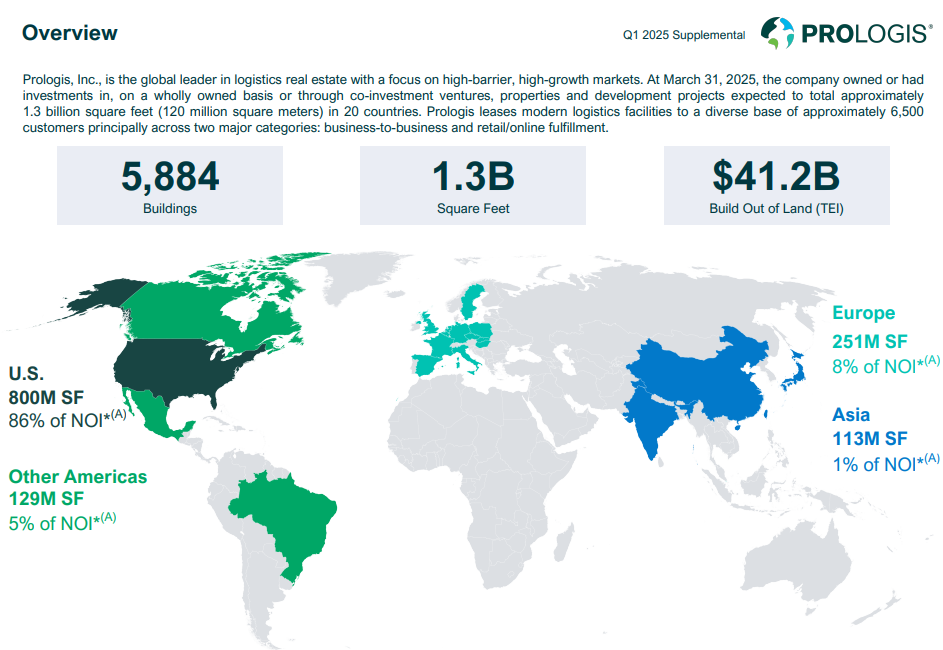

Prologis, the global giant in logistics real estate, just released its Q1 2025 earnings, and the numbers paint a nuanced picture of strength, challenges, and a cautiously optimistic outlook.

✅ The Good: Solid Core Performance, Resilient Fundamentals

- Revenue and Earnings Growth: Total revenues rose to $2.14B (from $1.96B YoY), with net earnings holding steady at $592M. Core FFO (Funds From Operations)—a key real estate profitability measure—jumped 11% to $1.36B.

- Strategic Capital Powerhouse: Strategic capital generated $141M in revenue this quarter, with $437M in fees and promote income over the last twelve months. This diversified income stream bolsters stability.

- Development Value Creation: Stabilizations yielded $240M in estimated value creation, with a hefty 6.9% yield on new developments—a sign that Prologis continues to deliver high-margin projects even amid macro uncertainty.

- Global Reach with High Occupancy: The portfolio now spans 1.3B square feet across 20 countries with average occupancy above 95%. Rent change on renewals remained strong, particularly in the U.S.

⚠️ The Bad: Softening Rent Growth, Capital Expenditures Up

- Rent Growth Cooling: Net effective rent change dropped to 53.7% (from 73.9% in Q2 2024) and cash rent change fell to 32.1%, reflecting pressure from slowing industrial demand.

- CapEx Still Elevated: Turnover costs hit $184M and total CapEx was $247M, eating into AFFO, which only grew modestly (+5% YoY).

- Occupancy Softening Slightly: Occupancy edged down to 95.2% from a high of 97.0% in Q1 2024, particularly outside the U.S.

🛑 The Ugly: Macro Drag and FX Pressures

- Currency Volatility: Foreign currency and derivative losses totaled $32M this quarter, dragging on net income. While much of 2025’s exposure is hedged, it’s still a risk.

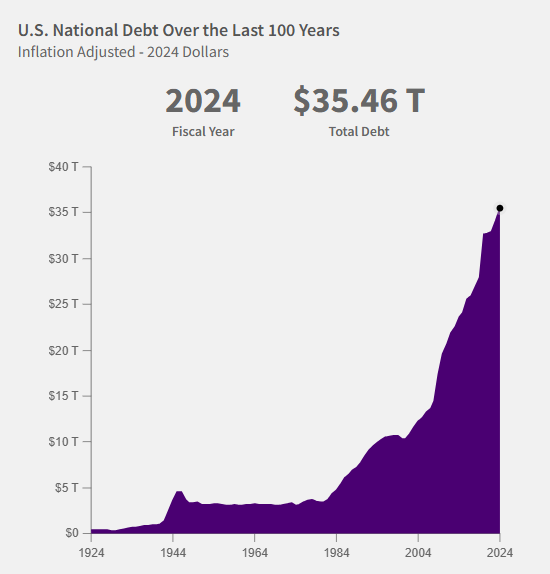

- Interest Expense Up: Interest costs increased by nearly 20% YoY, reflecting both higher debt levels and the sustained high-rate environment.

- Growth Outside the U.S. Still Lagging: Despite international diversification, 86% of NOI still comes from the U.S., with Europe and Asia contributing a relatively modest 8% and 1%, respectively.

🔭 Outlook: Steady but Watchful

Prologis projects 2025 Core FFO per share between $5.65–$5.81, modestly up from 2024. It expects continued development (up to $2B in new starts), solid occupancy (~95%), and rent growth of 4–5%. But, with muted acquisition activity, rising expenses, and macro clouds on the horizon, the focus is clearly on execution and efficiency over expansion.

Bottom Line: Prologis remains a powerhouse in logistics real estate, backed by durable cash flows and development strength. But as the global industrial boom cools and capital gets more expensive, management’s prudence will be critical to sustaining performance.