Tariffs Hit Hard:

Vietnam, Nike, and the Market’s Quiet Shifts

Tariffs came in hard—arguably harder than many expected. With sweeping measures targeting multiple countries, the recent announcement was more aggressive than what markets had priced in. Yet, there’s a whisper among some investors that these tariffs might not be permanent. Could they be a negotiating tool rather than a long-term policy shift? For now, markets aren’t waiting to find out—it’s been a “shoot first, ask questions later” kind of reaction.

While the headlines scream about trade wars, some of the most telling stories are unfolding quietly. Vietnam, a manufacturing hub for companies dodging U.S.-China tensions, got hit with steep tariff increases. Gold, usually a safe haven in times of trade uncertainty, has barely blinked. And Chinese equities? They’re shrugging it off, suggesting investors either expect government support or don’t see this as a game-changer. Let’s dive into these under-the-radar shifts and explore why they might matter more than the loud tariff buzz.

Vietnam Takes a Hit

Vietnam’s been caught in the tariff crosshairs, facing a hefty 46% tariff on its imports, which account for about 4.2% of U.S. import share. That’s a big swing for a country that’s seen its trade surplus with the U.S. balloon by 18% in 2024. Why the target on Vietnam’s back? It’s partly due to its growing role as a manufacturing alternative to China. But there’s more—allegations of transhipment have raised eyebrows. Some suspect Chinese manufacturers are rerouting goods through Vietnam to sidestep U.S. tariffs on China, putting Vietnamese exports under a microscope.

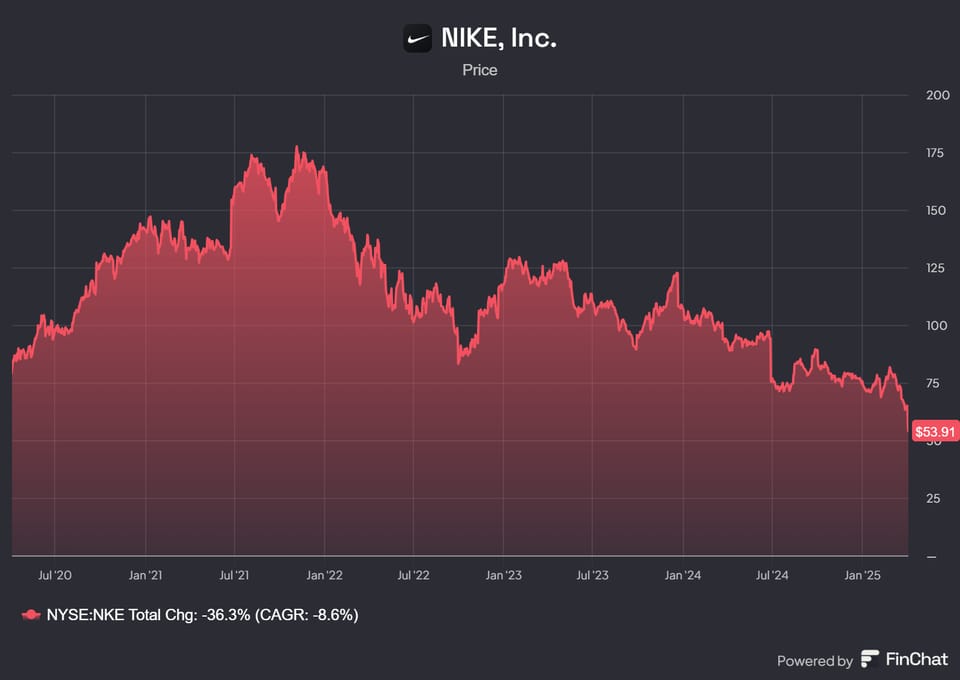

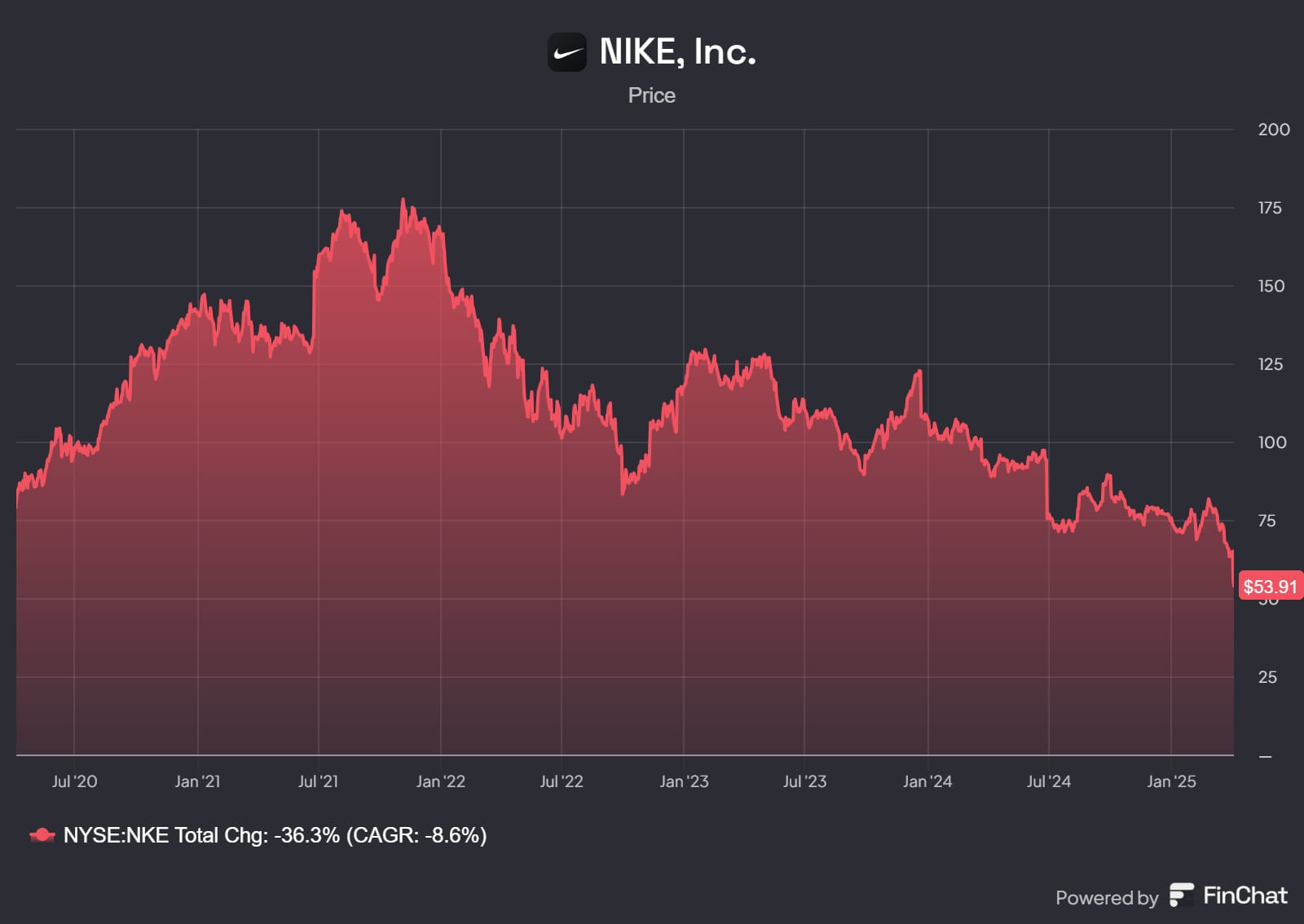

This spells trouble for U.S. companies that moved production to Vietnam to escape the U.S.-China trade spat. Take Nike, ON Holdings, and Deckers Outdoors—all three have leaned heavily on Vietnam, and their stock prices took a double-digit tumble after the tariff news broke. Here’s the breakdown:

- Nike: In the fiscal year ending May 31, 2024, Vietnam produced about 50% of its footwear and 28% of its apparel. That’s a massive chunk of its supply chain now facing higher costs.

- ON Holdings: Exact numbers are trickier to pin down, but reports suggest a significant portion of its production relies on Vietnamese facilities.

- Deckers Outdoors: With 68 supply chain partners in Vietnam (second only to its 125 in China), it’s deeply tied to the region.

Stock Slumps and Next Steps

The market didn’t waste time reacting—stocks for these companies dropped sharply. But what happens next? These firms face a tough choice:

- Pivot Back to China: If tariffs are a bargaining chip, a U.S.-China trade deal could ease pressures. For some products, China might even be cheaper despite its own tariffs. But betting on a deal is a gamble.

- Diversify Across Asia: Countries like Thailand, the Philippines, or Indonesia could be alternatives. The catch? Shifting production takes time and money—potentially years—leaving profitability exposed to Vietnam’s tariffs in the meantime.

Nike’s already bracing for impact. Its latest quarter showed a 41.5% gross profit margin, but it’s expecting a 4-5% hit this quarter, partly due to tariffs from China and Mexico. Add Vietnam’s new tariffs to the mix, and the damage could deepen. Keep an eye on trading updates from these companies—updated earnings models will reveal if the market’s knee-jerk sell-off holds water.

Gold Stays Flat

You’d think trade chaos would send gold soaring, right? Not this time. Despite the tariff shock, gold (XAU/USD) is hovering around $3,000, lower than pre-announcement levels. After a 100% rally since November 2022, this muted response is raising eyebrows. Some see it as a sign the rally’s due for a breather—maybe even a correction. Interestingly, retail investors are just now piling into gold ETFs like GLD, which could signal a classic “buy high, sell low” moment if the tide turns.

Chinese Equities Shrug

Meanwhile, Chinese equities have barely flinched. Why the calm? Investors might be banking on Beijing rolling out policy support to cushion any blow. Or maybe they think the tariffs won’t dent China’s economy long-term. Either way, the muted response contrasts sharply with the chaos elsewhere.

Why the Quiet Matters

The tariff headlines are loud, but these quieter shifts—Vietnam’s manufacturing woes, gold’s standstill, and China’s steady equities—could tell us more about where the global economy’s headed. Companies like Nike, ON Holdings, and Deckers Outdoors are at a crossroads, gold’s defying expectations, and China’s playing it cool. These subtle signals might just outlast the tariff noise, shaping trade and markets in ways we’re only starting to understand. Watch this space.