Tax Free Money - How To Open Your Roth IRA

How to Open a Roth IRA

A Roth IRA is a fantastic way to save for retirement with after-tax dollars, allowing your investments to grow tax-free and offering tax-free withdrawals in retirement (if rules are followed). Opening one is straightforward—here’s how to do it:

Step 1: Choose a Brokerage

You’ll need to pick a provider to open your Roth IRA. Here are some great options, with Fidelity as our top pick:

- Fidelity (Our Favorite)

- How to Start: Visit Fidelity’s website, click “Open an Account,” and select “Roth IRA.” You’ll need your Social Security number, bank account details, and some personal info. It takes about 10-15 minutes.

- Perks: No account fees or minimums to open, commission-free trades on stocks, ETFs, and options, and access to zero-expense-ratio index funds (a rare gem!). Fidelity also offers an excellent robo-advisor (Fidelity Go) with no fees for balances under $25,000, plus top-notch educational resources for beginners and a user-friendly platform. We love Fidelity for its low costs, flexibility, and high interest on uninvested cash—perfect for maximizing your retirement savings.

- Charles Schwab

- How to Start: Go to Schwab’s website, select “Open an Account,” and choose “Roth IRA.” Provide your Social Security number, employment info, and bank details. The process is quick and online.

- Perks: No account minimum or fees for standard accounts, $0 commissions on stocks and ETFs, and a huge selection of no-transaction-fee mutual funds (over 4,000). Schwab shines with its robust customer service, a powerful trading platform (thinkorswim), and a free robo-advisor option (Schwab Intelligent Portfolios) if you prefer hands-off investing. Great for active traders and those who value in-person support with 300+ branches.

- Vanguard

- How to Start: Head to Vanguard’s site, click “Open an Account,” and pick “Roth IRA.” You’ll need personal and banking info, and it might take a few days to fully activate.

- Perks: Known for low-cost index funds and ETFs, Vanguard has no commissions on most trades and a client-owned structure that keeps fees down (e.g., 0.20% for its Digital Advisor robo-service). It’s ideal for long-term, buy-and-hold investors who don’t need flashy trading tools but want reliable, low-expense options.

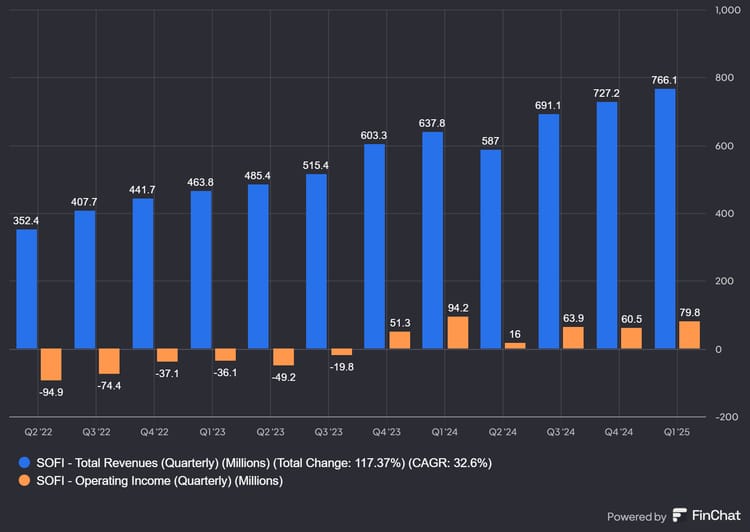

- SoFi

- How to Start: Visit SoFi’s website, select “Invest,” then “Open a Roth IRA.” Sign up with your personal and banking details—super simple.

- Perks: No account fees, $0 commissions on stocks and ETFs, and a 1% match on IRA contributions (a unique bonus!). SoFi offers automated investing with as little as $1 and free access to financial planners, making it a solid choice for beginners who want a modern, all-in-one financial app.

Step 2: Fund Your Account

Once your account is set up, link your bank account and transfer money. For 2025, you can contribute up to $7,000 annually (or $8,000 if you’re 50 or older). You can deposit a lump sum or set up recurring contributions—most providers let you automate this.

Step 3: Pick Your Investments

After funding, choose what to invest in—stocks, ETFs, mutual funds, etc. Fidelity and Schwab offer DIY options or robo-advisors to pick for you. Vanguard leans toward low-cost funds, while SoFi simplifies it with automated portfolios. Our favorite, Fidelity, gives you tons of flexibility, including unique zero-fee funds to stretch your dollars further.

Step 4: Review and Adjust

Log in occasionally to check your progress. Fidelity’s intuitive dashboard and planning tools make this easy, which is another reason it’s our top choice.

Why Fidelity Stands Out

While all these options are strong, Fidelity is our favorite because it combines zero fees, a massive investment selection, and beginner-friendly tools with advanced features for seasoned investors. Whether you’re starting small or building a big nest egg, Fidelity’s got your back with no hidden costs and exceptional value.

Ready to get started? Pick your provider, open that Roth IRA, and watch your retirement savings grow tax-free!