The State of the American Consumer

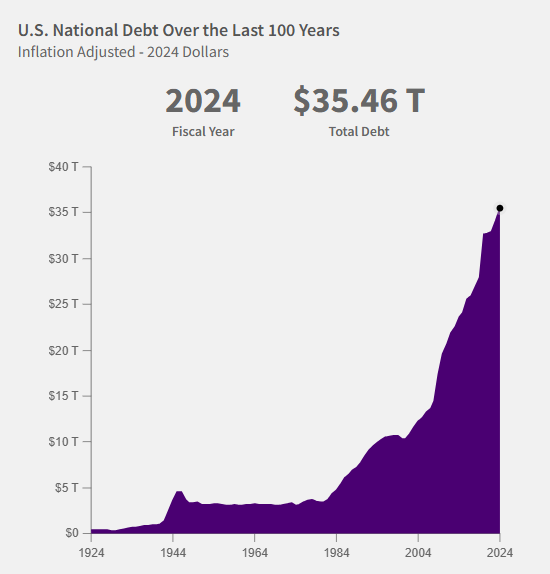

The Scary Picture that Debt is Painting

The American consumer in 2025 stands at a complex crossroads, navigating a landscape shaped by economic resilience, persistent inflation, and a significant reliance on borrowing to sustain lifestyles. While consumer spending continues to drive economic growth, rising debt levels—particularly high-interest debt—are casting a shadow over financial stability for many households. This article delves into the current state of the American consumer, with a sharp focus on debt levels, the prevalence of high-interest obligations, and the implications for the broader economy.

Total Household Debt: A Record High

As of the fourth quarter of 2024, total U.S. household debt reached $18.04 trillion, a 0.5% increase from the previous quarter, according to the Federal Reserve Bank of New York. This figure reflects a steady climb, with an additional $93 billion added in Q4 alone. The average household now carries approximately $105,056 in debt, a 13% rise from 2020’s average of $92,727. Mortgages, which account for roughly 70% of consumer debt, dominate at $12.61 trillion, followed by student loans ($1.62 trillion), auto loans ($1.66 trillion), and credit card debt ($1.21 trillion). Other debts, such as personal loans and retail cards, contribute smaller but growing shares.

While debt growth has slowed compared to the rapid increases seen in 2022, the sheer scale of borrowing underscores a reliance on credit to bridge gaps between income and expenses. The debt-to-income ratio, a key measure of financial strain, stood at 11.3% in Q3 2024, meaning the average American spends about 11% of their disposable income on debt payments. This is lower than peaks in the 2000s but signals ongoing pressure, particularly for lower- and middle-income households.

High-Interest Debt: A Growing Concern

High-interest debt—typically defined as obligations with interest rates exceeding those of mortgages (6.63% for a 30-year fixed in Q4 2024) or federal student loans (6.55% for undergraduates)—is a critical pain point. Credit card debt and personal loans fall squarely into this category, with average annual percentage rates (APRs) far outpacing secured loans.

Credit Card Debt: A Trillion-Dollar Milestone

Credit card debt has surged to $1.21 trillion, a record high, up $45 billion from Q3 2024. The average credit card balance per consumer is approximately $6,580, according to TransUnion, with Generation X carrying the highest average at $9,557. The average APR for credit cards accruing interest was 21.91% in Q1 2025, though new card offers often start at 24.23%. For the 47% of cardholders who carry a balance month-to-month, these rates translate to significant interest costs.

Delinquency rates, while still below historical highs, are climbing. As of Q4 2024, 3.08% of credit card balances were at least 30 days past due, and the share of accounts transitioning to serious delinquency (90+ days) has risen, particularly among younger borrowers aged 18–29. The Philadelphia Federal Reserve noted that 10.75% of active credit card accounts were making only minimum payments in Q3 2024—a record high—indicating cash flow stress for many households.

Personal Loans: Flexible but Costly

Unsecured personal loans, often used for debt consolidation or major expenses, carry an average balance of $11,652 per borrower, with an average interest rate of 12.32% for a 24-month loan in November 2024. Total personal loan debt is smaller than other categories, but its high-interest nature adds to the burden for those juggling multiple debt types. The slight decline in average loan amounts (from $8,644 to $8,514 year-over-year) suggests cautious borrowing, but interest accumulation often outpaces repayment for many.

Why High-Interest Debt Matters

High-interest debt is particularly insidious because it compounds quickly, eroding disposable income and limiting savings. For context, a $6,580 credit card balance at 21.91% APR, with only minimum payments, could take over 30 years to pay off, costing thousands in interest. This dynamic traps consumers in a cycle where debt grows faster than their ability to repay, especially as real wages struggle to keep pace with inflation (which hovered around 2.5–3% in early 2025).

The broader economic context exacerbates these challenges. Despite a robust labor market with a 4.0% unemployment rate, wage growth has slowed, and pandemic-era savings have largely been depleted. Posts on X reflect public sentiment, with users noting that “75% of Americans earn less than $25/hour” and that “the savings buffer is gone.” While these claims lack precise verification, they echo survey data showing 40–50% of Americans have less than $500 in savings, leaving little cushion for debt repayment or unexpected expenses.

Generational and Demographic Disparities

Debt burdens vary significantly across demographics. Generation X, now in their 40s and 50s, holds the highest total debt due to mortgages and credit card balances, while younger Millennials and Gen Z face rising delinquency rates on auto loans and credit cards. Racial disparities persist: white families carry higher average credit card balances ($6,940 in 2021) than Black ($3,940) or Hispanic ($5,510) families, but the latter groups face higher interest rates and lower credit access due to systemic inequities in lending.

Geographically, states like California and Hawaii see higher debt levels due to elevated living costs, with average mortgage balances exceeding $370,000 in some areas. Meanwhile, southern states like Mississippi show lower credit card balances but higher delinquency rates, reflecting economic constraints.

Economic Implications and Outlook

The rise in high-interest debt raises concerns about consumer spending, which accounts for roughly 70% of U.S. GDP. Retail sales dipped slightly in January 2025 (down less than 1% from December 2024), and consumer sentiment, per the University of Michigan’s February index, fell 10% from January. High debt servicing costs could further dampen discretionary spending, potentially slowing economic growth.

The Federal Reserve’s monetary policy adds another layer of complexity. The federal funds rate, at 4.50% in early 2025, is down from its 2023 peak, but credit card and personal loan rates remain elevated, as they adjust slowly to policy changes. While the Fed signaled potential rate cuts later in 2025, high APRs are likely to persist, squeezing borrowers further.

On the flip side, some economists argue that debt levels remain manageable in aggregate. The Kansas City Fed notes that debt-to-income ratios are historically low, and strong wage growth has kept delinquency rates below global financial crisis peaks. Yet, this optimism masks vulnerabilities for lower-income households, where high-interest debt consumes a disproportionate share of income.

Strategies for Consumers

For individuals, tackling high-interest debt requires strategic focus. Two common approaches are:

- Debt Avalanche: Prioritize paying off the highest-interest debt first to minimize total interest paid.

- Debt Snowball: Pay off smaller balances first for psychological wins, then tackle larger debts.

Balance transfer cards with 0% introductory APRs (up to 21 months) can provide relief, though fees and credit score requirements apply. Personal loans for consolidation may offer lower rates than credit cards but require discipline to avoid new debt. Budgeting, building emergency savings, and negotiating payment plans with creditors are also critical steps.