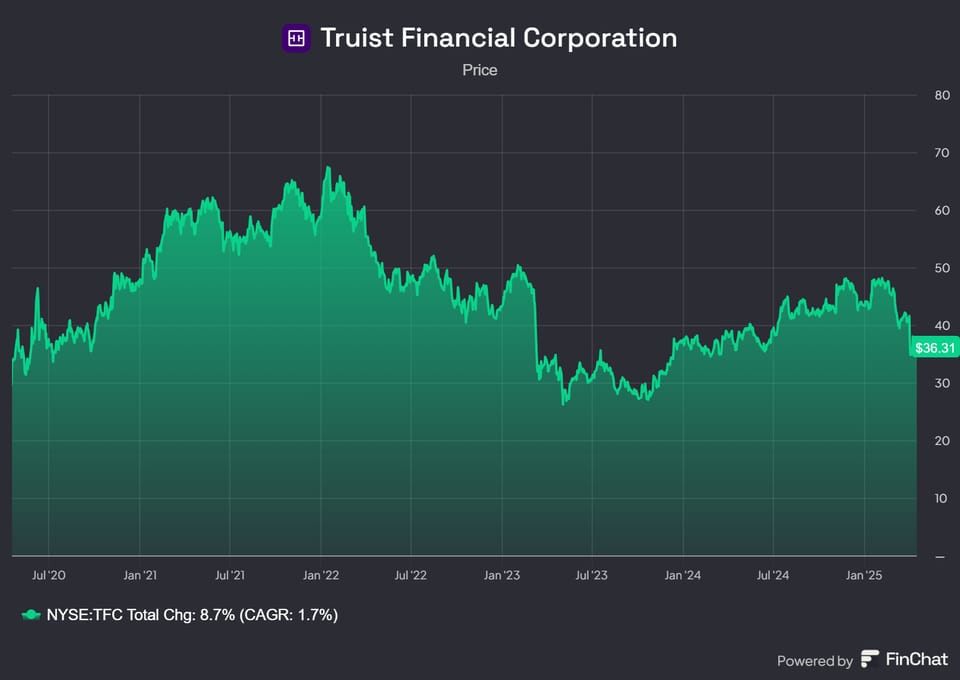

Truist Financial Q1 2025

The Good, The Bad, The Ugly, and The Outlook

The Good

- Strong Net Income: Truist delivered $1.2 billion in net income available to common shareholders, translating to $0.87 in diluted earnings per share.

- Cost Control: Adjusted noninterest expenses declined 5.4% from the previous quarter, driven by reductions in professional fees, technology costs, and equipment expenses.

- Solid Loan and Deposit Growth: Average loans grew by 1.1% and deposits rose by 0.6% quarter-over-quarter.

- Premier Banking Performance: Deposit and lending production per Premier banker increased 23% and 46% year-over-year, respectively.

- Digital Engagement: 40% of new-to-bank clients originated through digital channels. Digital loan funding was up 31% year-over-year, with Gen Z loan growth at 47%.

- Shareholder Returns: $500 million in share repurchases completed in Q1, with a target of up to $750 million in Q2.

The Bad

- Declining Net Interest Income: NII fell 3.2% quarter-over-quarter, impacted by two fewer calendar days and lower funding credit.

- Lower Noninterest Income: Down 5.3% from Q4, mainly due to a decline in other income and seasonality in investment-related fees.

- Wholesale Banking Margin Pressure: Segment net income fell to $888 million, driven by weaker noninterest income and slight deposit declines.

The Ugly

- Net Interest Margin Compression: The NIM slipped to 3.01% from 3.07% in the prior quarter, reflecting margin pressure across lending and investment activities.

- ROTCE Erosion: Return on Tangible Common Equity dropped to 12.3% from 12.9% in Q4 and significantly from 16.3% a year ago.

- Capital Ratio Dip: CET1 ratio fell 20 basis points to 11.3%—still strong, but a slight decline due to share buybacks, CECL phase-in, and risk-weighted asset growth.

The Outlook

Q2 2025 Guidance:

- Adjusted revenue expected to grow 1–2%

- Adjusted expenses projected to rise 2–3%

- Share repurchases targeted up to $750 million

Full-Year 2025 Guidance:

- Adjusted revenue growth of 1.5–2.5%

- Adjusted expenses up roughly 1%

- Implied positive operating leverage of 50–150 basis points

- Stable net charge-off ratio around 60 basis points

- Effective tax rate expected at 17% (20% FTE)

Truist is executing on strategic initiatives while carefully managing costs, digital transformation, and credit risk. While headwinds such as margin pressure and capital usage persist, the bank appears well-positioned for a wide range of economic conditions.