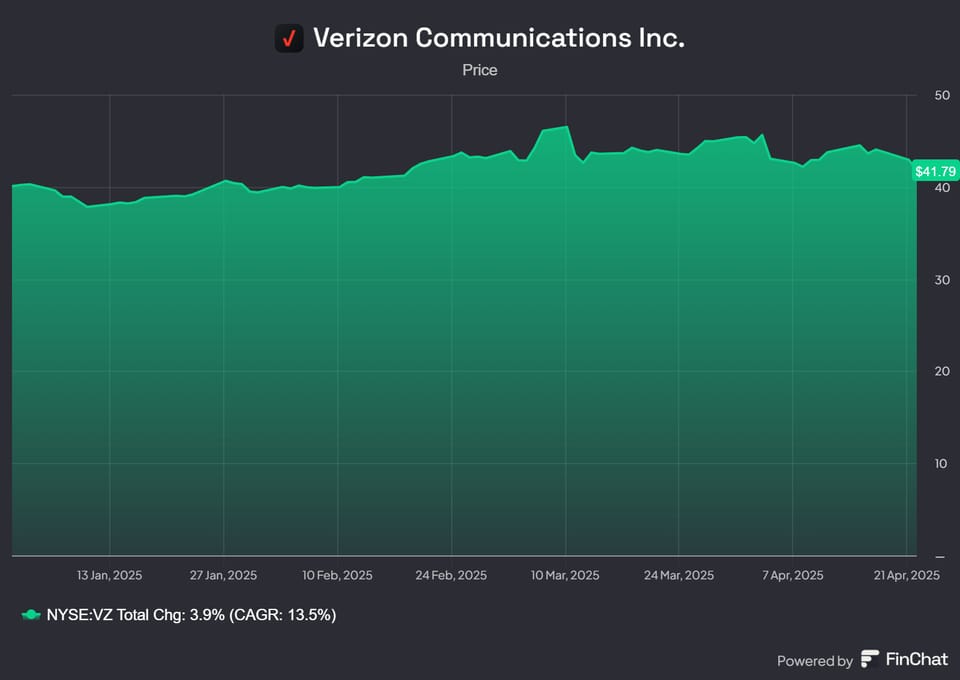

Verizon Starts 2025 Strong with Boost in Wireless and Broadband Growth

Verizon Communications kicked off 2025 on a high note, reporting impressive financial growth in its Q1 earnings. With a strategic focus on customer segmentation and diversified offerings, the company saw gains across its mobility and broadband services.

📈 Financial Highlights

- Wireless service revenue hit an industry-leading $20.8 billion, up 2.7% year-over-year.

- Total operating revenue climbed to $33.5 billion, a 1.5% increase from Q1 2024.

- Net income reached $5 billion, up from $4.7 billion the year prior.

- Earnings per share (EPS) rose to $1.15 (adjusted EPS: $1.19).

- Free cash flow grew to $3.6 billion, a notable increase from $2.7 billion in Q1 2024.

📱 Mobility Momentum

Despite a loss of 289,000 postpaid phone subscribers, Verizon’s wireless revenue remained strong. Equipment revenue also ticked up slightly, and the company continues to benefit from a high-value customer base and promotional offerings like the 3-year price lock and My Biz Plan.

🌐 Broadband Breakthrough

Verizon added 339,000 broadband subscribers, with fixed wireless access (FWA) net additions reaching 308,000, pushing the total FWA base to over 4.8 million. Fios internet added 45,000 subscribers, with total broadband connections growing 13.7% year-over-year.

🏠 Consumer Segment

- Revenue: $25.6 billion (+2.2%)

- Wireless service revenue: $17.2 billion (+2.6%)

- Fixed wireless additions: 199,000

- Segment EBITDA: $11 billion, up 2.7%

Churn remained low, and prepaid saw a bounce-back with 137,000 net additions — a turnaround from net losses the year before.

🏢 Business Segment

- Revenue: $7.3 billion (-1.2%)

- Wireless service revenue: $3.6 billion (+2.8%)

- Segment EBITDA: $1.7 billion, up 10.3%

- Fixed wireless net additions: 109,000

The business arm benefited from a strong uptick in wireless growth and improved margins, despite an overall revenue dip.

🔮 Outlook for 2025

Verizon reaffirmed its confidence in full-year guidance, projecting:

- Wireless service revenue growth of 2.0% to 2.8%

- Adjusted EBITDA growth of 2.0% to 3.5%

- Free cash flow between $17.5B – $18.5B

With momentum in both consumer and business segments and a continued focus on product innovation and customer-centric strategies, Verizon is well-positioned to maintain its leadership in the telecom space throughout 2025.